Why Lenders Never Discuss greendayonline legit The Bad Side Of Payday Loans

Content

A payday loan is a short-term, small-dollar loan that many borrowers use for financial emergencies, or to stretch their money to the next payday. This means that you won’t need to offer up any collateral in order to be approved. Payday loans are given based solely on the borrower’s ability to repay, and sometimes their credit history and income. A small credit record may make it hard for you to have an excellent credit rating.

- Furthermore, some wiggle room can be available depending on the lender.

- Accredited lenders are noted on the bureau’s internet site, along side customer care ranks and feasible complaints.

- That does not mean that there aren’t websites out there that prey on Middletown residents with bad credit.

- You might, in unusual cases, find that you have at least two financiers interested in loaning you money.

- This allows you to choose the best lending offer for your financial requirements.

Influence exactly how-to boost their credit history and you may data far better would it fast. Be careful though because it can easily escalate into a situation where money is borrowed over and over again. You do not want to abuse the privilege and find yourself in worse shape than when you started out. A payday advance works only if you use it wisely and cautiously. Most money lenders will offer you a loan equivalent to a month’s salary, which they will deduct from the wages you subsequently receive.

Lendingpoint

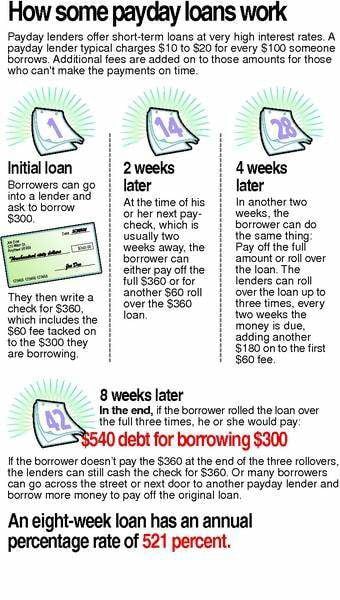

The 5 Cs of credit are character, capacity, collateral, capital, and conditions. The 5 Cs of credit are important because lenders use them to set loan rates and terms. Most states have usury laws that limit interest charges to anywhere from 5% to 30%. However, payday lenders fall under exemptions that allow for their high interest. Financial wellbeing is all about remaining in control on your money, building your savings and living comfortably whilst moving towards becoming financially free. Payday loans hinder your financial wellbeing and prevent you from working on things for your future self.

The Reasons People Take Payday Loans

In this review, we’ve highlighted five that offer quality services. Do some extensive research to see which ones provide reliable services. As a result, someone with greendayonline legit bad credit will have more borrowing expenses and lower loan amounts than someone with good credit. This is due to the fact that the loan expert is dealing with higher risk..

Once you are prequalified for a loan, you can check the terms and conditions without obligation before making a decision. In many cases, the fast cash from a same day loan arrives in your bank within 24 hours. Our team of independent experts pored over the fine print to find the select personal loans that offer competitive rates and low fees.

In recent years, business closures and layouts have caused many people to run into trouble no matter how carefully they normally manage their finances and debt. All the brokers and lenders above look at other factors, especially a steady income. There is still something to be said for dealing with companies on a face-to-face basis. Note that this company is a lender, not a loan broker, and its rates don’t always stack up well to those you can get by comparing multiple offers. Cocoloan excludes lenders with questionable practices or too many customer complaints from its network. This can be a definite plus if you don’t know much about same day personal loans and don’t want to get taken in by false advertising.

What Are Online Payday Loans, And How Do They Work?

But the more you do it, the more of a habit it becomes, until you no longer notice those extra bits of cash going from your spending into your savings. You could also consider selling off anything that you have but don’t need. For example, having a couple of garage sales or selling some stuff on Craigslist could easily raise a few hundred dollars. Will simply take the amount that was advanced out of your next direct deposit, as agreed in the app.

They offer a number of financial services, including making instant payday loans online or when you apply at one of their offices. This is because it mainly offers personal loans, not very short-term payday advances meant to be paid back within a few weeks. Conversely, though the theoretical maximum loan amount is attractively high, anyone with poor credit will struggle to get approved for more than $2,000 or so. This loan broker is therefore best for people who need larger sums quickly and have average to good credit. Quick payday loans are meant to be paid back within weeks, normally with your next paycheck. This makes them a good option if your credit score is below 500.

You can increase your approval odds by following a few simple steps. These caps mean you should never pay more than £24 per month for every £100 borrowed and never more than double the original amount borrowed. If you have a good job and you’ve kept your debt to a minimum, then getting a traditional loan is much easier and will do less harm to your score.

Comentários